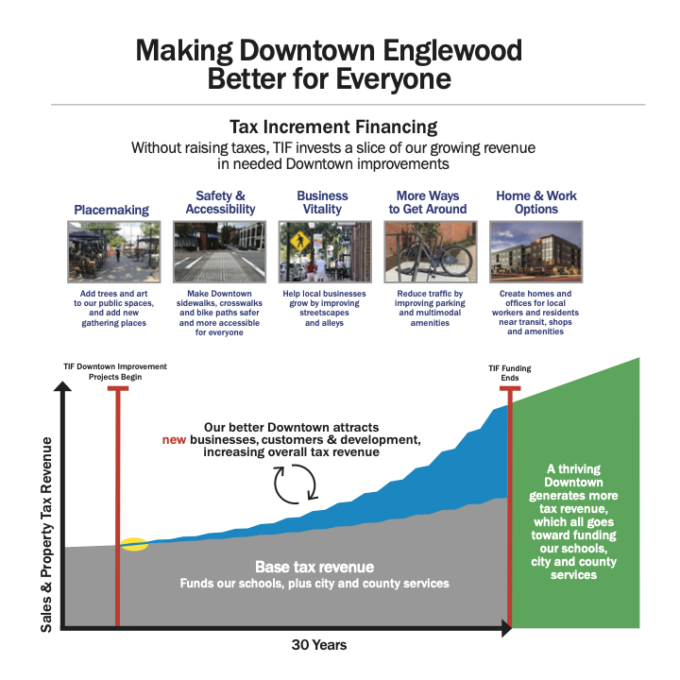

Tax Increment Financing (TIF) is a public financing method that municipalities use to encourage economic development and infrastructure improvements in designated areas. By leveraging future increases in property tax revenues, TIF provides immediate funding for projects that might otherwise be financially unfeasible. This mechanism has become a staple in urban development, enabling cities to revitalize blighted areas and stimulate private investment.

Establishment of Tax Increment Financing

The process of establishing a TIF district begins with the identification of an area in need of economic revitalization. Local governments assess regions that exhibit signs of blight, underdevelopment, or economic stagnation. Once a suitable area is identified, the municipality proposes the creation of a TIF district, outlining the specific boundaries and the intended public improvements or development projects. This proposal typically includes a detailed plan that projects the anticipated increase in property values and the corresponding tax increments. Public hearings are then held to gather input from community members, ensuring transparency and community involvement. Upon approval by the governing body, the TIF district is officially established, and the base property tax value is recorded.

Operation of Tax Increment Financing

Once a TIF district is established, the property tax revenue generated within its boundaries is divided into two components: the base revenue and the increment. The base revenue corresponds to the original assessed value of the property before the TIF designation. Which continues to flow into the general fund of the taxing authorities. The increment, which is the additional tax revenue resulting from the increase in property values due to development, is funneled into a special TIF fund. This fund is then used to finance the approved projects within the district. Such as infrastructure improvements, land acquisition, or public facilities. By capturing the future tax benefits of current investments, TIF enables municipalities to undertake significant projects without imposing additional taxes on residents.

Utilization by Developers

Developers play a crucial role in the success of TIF districts. By partnering with municipalities, developers can access funding for infrastructure and other major components of their projects through the anticipated tax increments. This collaboration often involves agreements. The developer fronts the initial costs for improvements, with the understanding that they will be reimbursed over time as the project generates increased property tax revenue. This arrangement reduces the financial risk for developers and encourages private investment in areas that may have been previously overlooked. Moreover, the improvements funded by TIF can enhance the overall appeal of a development, attracting businesses and residents alike.

Comparison with Public Improvement Districts (PIDs)

While both TIF and Public Improvement Districts (PIDs) are tools used to finance public improvements, they differ in structure and funding mechanisms. In a PID, property owners within a defined area agree to an additional assessment or tax to fund specific improvements directly benefiting their properties. These assessments are collected annually and are used to pay for the improvements over time. In contrast, TIF does not impose additional taxes on property owners. Instead, it reallocates the increased tax revenue resulting from rising property values within the district to fund the improvements. While PIDs rely on upfront contributions from property owners, TIF leverages future tax increments, making it a more indirect method of financing.

Tax Implications within TIF Districts

Properties within a TIF district continue to pay property taxes based on their assessed values. However, the distribution of these taxes changes with the establishment of the district. The base tax revenue, corresponding to the property’s value before the TIF designation, continues to support general municipal services. The incremental tax revenue, generated from the increase in property values due to development, is allocated to the TIF fund. Importantly, property owners do not experience an increase in their tax rates due to the TIF; rather, the allocation of where their taxes are directed changes to support the development projects within the district.

Examples of Tax Increment Financing Projects

-

Manistee Gateway Project, Michigan: The Manistee Downtown Development Authority approved the use of TIF for the Gateway Project. A $78 million redevelopment initiative. The TIF mechanism will capture the incremental tax revenue generated by the increased property values post-development to finance the project’s costs. This approach allows the city to undertake significant redevelopment without imposing additional taxes on residents.

-

San Antonio Spurs Arena, Texas: San Antonio plans to utilize a project financing zone, similar to TIF, to fund a proposed $1 billion arena for the Spurs. The zone allows the city to collect state hotel taxes within a specific radius. Generating an estimated $2.48 billion over 30 years. This revenue will finance the new arena and related developments, showcasing how future tax revenues can support large-scale projects.

-

Mesa del Sol Development, Albuquerque, New Mexico: Mesa del Sol is one of the largest TIF projects in the United States, with a projected cost of $500 million. The development utilizes future tax increments to finance infrastructure and public improvements. Transforming a previously underdeveloped area into a vibrant mixed-use community. This project exemplifies how TIF can stimulate large-scale urban development.

In conclusion, Tax Increment Financing serves as a powerful tool for municipalities and developers to collaborate on revitalizing underdeveloped areas. By capturing future tax increments, TIF provides immediate funding for essential projects without increasing the tax burden on current residents. Understanding the mechanics and implications of TIF is crucial for stakeholders considering its implementation in their development strategies.