Delaware Statutory Trusts: A 1031 Exchange Investment Option

What Is a Delaware Statutory Trust (DST)?

A Delaware Statutory Trust (DST) is a legal entity that allows multiple investors to own fractional interests in real estate. It operates under Delaware law and provides a structure for passive investment in institutional-grade properties. DSTs are commonly used in 1031 exchanges, offering investors a way to defer capital gains taxes while diversifying their real estate portfolios.

The History of Delaware Statutory Trusts

DSTs originated in Delaware’s trust law and gained prominence after a 2004 Internal Revenue Service (IRS) ruling recognized them as a valid structure for 1031 exchanges. This ruling allowed investors to use DSTs as replacement properties in tax-deferred exchanges, significantly increasing their popularity among those seeking passive real estate investments.

How a 1031 Exchange Into a DST Works

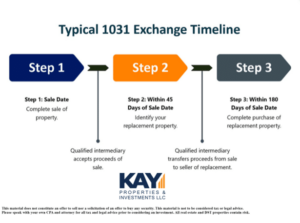

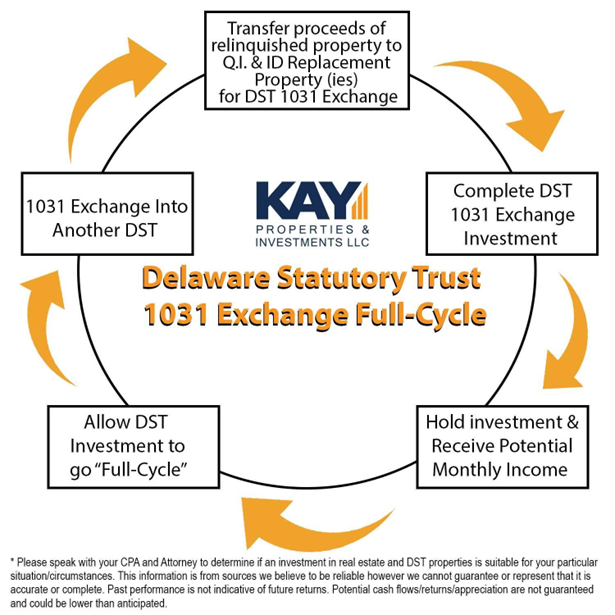

A real estate owner can use a 1031 exchange to reinvest proceeds from the sale of an investment property into a DST. The process follows standard 1031 exchange rules:

- Sell the Original Property – The investor sells their investment property and places the proceeds with a Qualified Intermediary (QI).

- Identify Replacement Properties – Within 45 days, the investor selects potential DST investments as replacement properties.

- Complete the Exchange – The investor must reinvest the proceeds into a DST within 180 days to qualify for tax deferral.

- Receive Passive Income – The investor becomes a fractional owner in a professionally managed property and receives a share of the income.

Types of DSTs Allowed in a 1031 Exchange

DSTs hold various types of investment-grade properties, including but not limited to:

- Multifamily apartment buildings

- Office buildings

- Industrial warehouses

- Retail centers

- Senior living communities

- Medical facilities

These properties are typically high-value assets managed by experienced real estate operators, ensuring professional oversight and stability.

Rules and Timing for DST Investments

Investors must follow IRS regulations for DST investments in a 1031 exchange:

- The 45-Day Rule – Investors must identify replacement DST properties within 45 days of selling their original asset.

- The 180-Day Rule – The full reinvestment must be completed within 180 days to defer capital gains taxes.

- No Active Management – DST investors hold a passive ownership interest and cannot actively manage the property.

- Debt Matching – If the relinquished property had debt, the DST investment must have an equivalent amount of leverage to maintain tax deferral.

Advantages of DSTs for Investors

DSTs provide several benefits for real estate investors:

- Tax Deferral – DSTs qualify for 1031 exchanges, allowing investors to defer capital gains taxes.

- Diversification – Investors can allocate funds across multiple DSTs in different sectors and locations.

- Passive Investment – Professional property managers handle day-to-day operations, freeing investors from direct management responsibilities.

- Access to Institutional Properties – Investors gain fractional ownership in high-quality assets that would be difficult to acquire individually.

- Estate Planning Benefits – DST ownership can be transferred to heirs, preserving wealth across generations.

Conclusion

Delaware Statutory Trusts offer a compelling option for real estate investors seeking tax-deferral benefits, passive income, and diversification. By utilizing a DST in a 1031 exchange, investors can reinvest in institutional-grade properties while maintaining compliance with IRS regulations. For more information, visit the IRS 1031 Exchange Guide.