Understanding Improvement Districts and Their Role in Development

Improvement Districts create specialized zones to finance and manage public infrastructure and services within a defined area. These districts help property owners and businesses fund improvements that boost economic growth and enhance community appeal. Various types of Districts exist, each with distinct structures and funding mechanisms. They have many different names, but all function on the same basic principals.

How Improvement Districts Are Established and Operated

Property owners, businesses, or local governments initiate Improvement Districts by identifying a need for specific enhancements. They draft a proposal that defines district boundaries, improvement types, and funding methods. Public hearings gather community feedback and ensure transparency before governing bodies approve the district. After approval, the district levies taxes or assessments on properties or businesses to fund planned improvements. A governing board, usually consisting of stakeholders, oversees project implementation and maintenance.

How Developers Use Improvement Districts

Developers utilize these types of Districts to fund infrastructure and significant components of their projects. By forming or participating in these districts, they finance roads, utilities, landscaping, and public amenities without bearing the full financial burden upfront. This approach distributes costs among property owners, making large-scale developments more feasible. Investors and residents also find these projects more attractive due to shared infrastructure costs.

Types of Improvement Districts and Their Functions

- Public Improvement Districts (PIDs)

PIDs allow property owners to fund public facilities like street improvements, water distribution systems, and parks. These districts finance improvements through property assessments. For example, Larimer County, Colorado, has PIDs that fund public infrastructure through additional mill levies. Property taxes increase to support these enhancements. Larimer County PID Brochure

- Business Improvement Districts (BIDs)

BIDs support business areas by funding services like marketing, security, and infrastructure upgrades. Businesses within the district contribute through additional assessments. New York City BIDs invest over $158 million annually to improve commercial districts, increasing foot traffic and economic activity. NYC BID Information

- General Improvement Districts (GIDs)

GIDs finance broad public infrastructure projects like water systems, streets, and parks. They obtain funding through property taxes or special assessments. Loveland, Colorado, uses GIDs to finance projects supporting growth and community development. Property taxes increase to cover improvement costs. Loveland GID Information

- Local Improvement Districts (LIDs)

LIDs finance local infrastructure projects like street paving, sidewalks, and drainage systems. Property owners benefiting from improvements share the costs. Portland, Oregon, applies LIDs to street paving projects. Property owners pay based on their frontage’s share of project costs. Portland LID Information

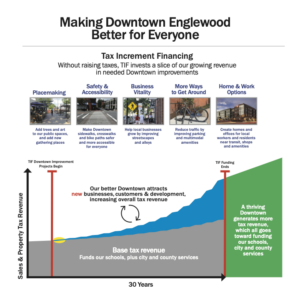

Tax Implications of Improvement Districts

Each Improvement District levies taxes or assessments based on district type and project scope. Property owners or businesses within the district contribute proportionally to the benefits received. These assessments supplement existing property taxes and exclusively fund specified improvements.

Examples of Tax Impacts in Improvement Districts

- Public Improvement District (PID): Larimer County, Colorado, levies an additional mill tax on properties to fund public facilities. A $300,000 home may pay an extra $536 annually. Larimer County PID Brochure

- Business Improvement District (BID): New York City businesses in a BID contribute assessments based on property value or square footage. These funds enhance public spaces and increase commercial activity. NYC BID Information

- Local Improvement District (LID): Portland, Oregon, assesses property owners for street improvements based on their frontage. If a project costs $1 million, an owner with 1% frontage pays $10,000. Portland LID Information

Conclusion

Improvement Districts effectively finance and manage public infrastructure and services. By distributing costs among beneficiaries, they enable enhancements that might otherwise remain unattainable. Understanding these districts and their tax impacts helps property owners, businesses, and developers make informed decisions about participation.