Understanding 721 Exchanges and UPREITs

What Is an UPREIT?

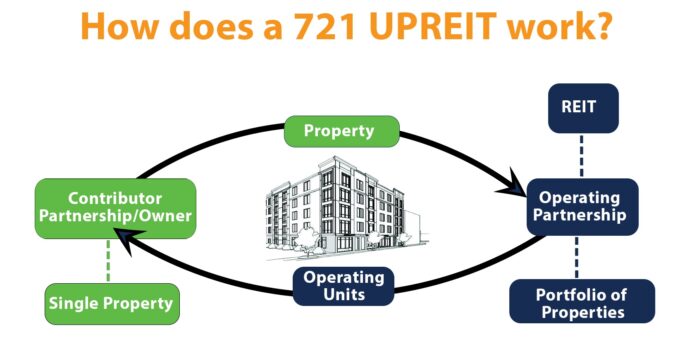

A Umbrella Partnership Real Estate Investment Trust (UPREIT) is a structure that allows property owners to contribute their real estate holdings to a real estate investment trust (REIT) in exchange for operating partnership (OP) units. This structure enables investors to transition from direct real estate ownership to a share in a professionally managed real estate portfolio while deferring capital gains taxes.

History of UPREITs and 721 Exchanges

UPREITs emerged in the early 1990s as a response to growing demand for tax-efficient real estate investment structures. The IRS established the 721 exchange, a provision under Section 721 of the Internal Revenue Code, allowing property owners to exchange their real estate for OP units in a REIT without triggering an immediate capital gains tax.

How Investors Use UPREITs

Real estate owners use 721 exchanges to transition from direct property ownership into a more liquid and diversified real estate investment. Here’s how the process works:

- Contribution of Property – The investor contributes real estate assets to the REIT’s operating partnership.

- Receipt of OP Units – Instead of receiving cash, the investor is issued OP units equivalent to the value of the property.

- Tax Deferral – The transaction does not immediately trigger capital gains taxes, similar to a 1031 exchange.

- Liquidity Option – Over time, OP units can be converted into REIT shares, providing increased liquidity compared to direct real estate ownership.

Types of UPREITs

UPREITs can focus on different real estate asset classes, including:

- Retail REITs – Invest in shopping centers, malls, and retail properties.

- Office REITs – Own and manage office buildings in major markets.

- Industrial REITs – Specialize in warehouses, logistics, and distribution centers.

- Residential REITs – Invest in multifamily housing and single-family rental portfolios.

- Hospitality REITs – Own hotels and short-term rental properties.

- Healthcare REITs – Focus on senior living, hospitals, and medical office buildings.

Rules Associated With UPREITs

Investors must adhere to specific IRS regulations when using a 721 exchange:

- The contributed property must be real estate, not personal property or business assets.

- OP unit holders may be subject to certain restrictions on converting units into REIT shares.

- Upon conversion to REIT shares, the deferred capital gains taxes become due if shares are sold.

Advantages of UPREITs

UPREITs offer several benefits to real estate investors:

- Tax Deferral – Investors can defer capital gains taxes when contributing real estate to an UPREIT.

- Diversification – Ownership in a REIT provides access to a broad portfolio of properties.

- Liquidity – OP units can eventually be converted into publicly traded REIT shares.

- Professional Management – Investors gain exposure to institutional-grade assets managed by experienced professionals.

Disadvantages of UPREITs

Despite their benefits, UPREITs also have some drawbacks:

- Loss of Control – Investors no longer directly manage their property.

- Market Risk – REIT shares fluctuate based on market conditions, affecting overall returns.

- Tax Liability Upon Sale – When OP units are converted to REIT shares and sold, deferred taxes become due.

- Limited Redemption Options – Some REITs impose holding periods or conversion restrictions on OP units.

Conclusion

A 721 exchange into an UPREIT allows real estate investors to transition into a tax-deferred, professionally managed, and diversified investment structure. However, investors must weigh the benefits of diversification and liquidity against the loss of direct control and potential tax liabilities upon conversion. To learn more, visit the IRS 721 Exchange Guide or consult a tax advisor for personalized guidance.