Understanding Cap Rates in Real Estate

What Is a Cap Rate?

A cap rate, or capitalization rate, expresses a property’s expected return as a percentage. It shows how much income a property might generate relative to its value.

You calculate it by dividing Net Operating Income (NOI) by the property’s current market value.

In formula form:

Cap Rate = NOI ÷ Market Value × 100

For example, if a property produces $100,000 in NOI and its market value is $2,000,000, its cap rate is 5%.

How Cap Rates Are Used

Cap rates help investors compare properties quickly.

-

They act as a shorthand metric for yield or return.

-

They support valuation: investors can invert the formula (NOI ÷ cap rate) to estimate what a property should be worth.

-

They reveal risk: a higher cap rate often suggests higher risk or less demand, while a lower cap rate implies safer or more desirable assets.

-

They exclude debt: cap rate is an unlevered metric. It ignores mortgage costs, focusing only on property operations.

However, cap rates do not handle future growth, financing structure, or unusual income/expense fluctuations.

Step-by-Step: Calculating Cap Rate

-

Estimate gross annual income. Include rent, fees, and other property income sources.

-

Subtract operating expenses. Exclude debt service, depreciation, and income taxes.

-

Obtain NOI. That’s (income minus expenses).

-

Divide NOI by market value. (NOI ÷ value)

-

Convert to percentage. Multiply result by 100.

For instance, a property with $80,000 NOI and a $1,600,000 value results in a 5% cap rate.

You can also derive value:

Value = NOI ÷ Cap Rate

If similar buildings trade at 6% cap rates, a $120,000 NOI suggests value near $2,000,000.

Cap Rates in Practice: Tips and Caveats

-

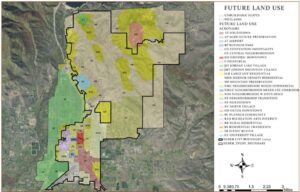

Compare cap rates only among properties in similar markets and classes.

-

Watch for vacancy adjustments, reserve funds, and maintenance costs in NOI.

-

Be careful in transitional or timing-sensitive markets—cap rates may shift rapidly.

-

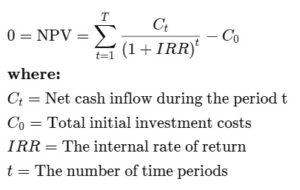

Use cap rates alongside discounted cash flow (DCF) and other valuation tools.

-

Recognize that cap compression can happen: demand pushes property values up and cap rates down.

Closing Thoughts

Cap rates offer a clear, immediate lens on income properties. When used correctly, they guide comparisons and valuation. But they are not a complete tool. Always supplement cap rate analysis with deeper cash flow modeling and market insight.

References: