Understanding Internal Rate of Return (IRR) in Real Estate

What Is IRR?

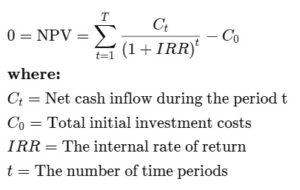

Internal Rate of Return (IRR) is the annualized rate that makes all investment cash flows equal zero in present value.

In other words, IRR tells you the expected rate of return, considering both timing and size of cash flows.

A higher IRR usually indicates a more attractive investment if risk aligns with expectations.

How to Calculate IRR

You find IRR by solving for the rate “IRR” in this equation:

Because multiple cash flows make the equation complex, most investors use Excel, financial calculators, or other software.

How Real Estate Investors Use IRR

Real estate investors use IRR to compare deals with different cash flow patterns.

They consider both operating cash flows (rent minus expenses) and exit proceeds (sale or refinance) when holding periods end.

IRR accounts for timing, showing how early or late cash flows influence overall returns.

It also acts as a benchmark: if IRR exceeds your required return, the investment is attractive.

However, IRR assumes reinvestment of intermediate cash flows at the same rate, which may not always hold.

Step-by-Step Example

Suppose you invest $1,000,000 in a property. Net cash flows over five years are:

-

Year 1: $80,000

-

Year 2: $90,000

-

Year 3: $100,000

-

Year 4: $110,000

-

Year 5: $120,000 + $1,500,000 from sale

Input these values into Excel’s IRR function. Excel solves for IRR, for this example, 17.95%.

Key Takeaways

-

IRR reflects the annualized return on investment considering timing of cash flows.

-

Use IRR to compare investments with differing sizes, cash flows, or exit strategies.

-

Always review assumptions: reinvestment rates, timing, and risk.

-

Pair IRR with NPV or equity multiples for a complete analysis.

References:

-

Investopedia: Internal Rate of Return (IRR)

-

J.P. Morgan Insight: What is Internal Rate of Return in Commercial Real Estate?