Real Estate Investment Trusts (REITs): An Overview

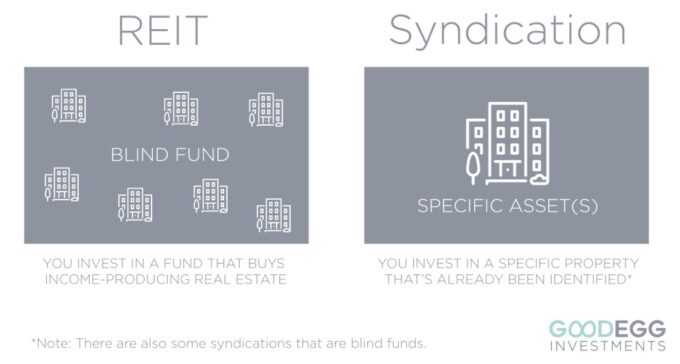

Real Estate Investment Trusts (REITs) provide investors with opportunities to invest in income-generating real estate without owning physical properties. REITs function like mutual funds, allowing individuals to buy shares in a diversified real estate portfolio.

The History of REITs

The U.S. Congress established REITs in 1960 to enable individual investors to access large-scale, income-producing real estate. The goal was to allow everyday investors to benefit from commercial real estate profits without needing significant capital. Since then, REITs have grown into a global industry with trillions in assets.

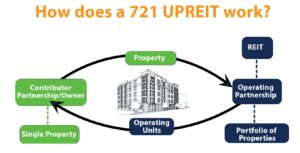

How a Property Becomes Part of a REIT

A real estate property enters a REIT portfolio when the trust acquires it for income generation. Unlike traditional syndicated real estate equity investments, REITs own and manage properties rather than pooling investor funds for single-property deals. Property owners often sell assets to REITs in exchange for liquidity, tax advantages, or diversification benefits.

Differences Between Exchange-Traded and Private REITs

REITs come in two main types: exchange-traded REITs (publicly traded) and private REITs (non-traded). Each type has distinct characteristics, benefits, and risks.

Exchange-Traded REITs

Exchange-traded REITs (ETFs) trade on major stock exchanges like shares of common stock. Investors can buy and sell shares easily, benefiting from liquidity and transparency. Public REITs must adhere to strict financial disclosure requirements and provide dividends.

Pros:

- High liquidity due to stock exchange trading

- Transparency with SEC regulations and reporting

- Diversified real estate exposure

Cons:

- Subject to stock market volatility

- Lower control over specific property investments

- Market fluctuations can impact share prices

Private REITs

Private REITs do not trade on public exchanges and typically require higher minimum investments. They cater to accredited investors and institutions, offering real estate ownership without stock market exposure.

Pros:

- Less correlation with stock market volatility

- Potentially higher returns through direct real estate investment

- Long-term income stability

Cons:

- Limited liquidity; shares are difficult to sell

- Less regulatory oversight compared to public REITs

- High minimum investment requirements

Barriers to Entry for Investors

Investing in REITs has fewer barriers than traditional real estate ownership, but some challenges exist. Public REITs are accessible to most investors, while private REITs require accreditation and substantial capital. Understanding market risks, taxation, and property performance is crucial before investing.

Conclusion

REITs offer a way for investors to gain real estate exposure without direct property ownership. Exchange-traded and private REITs each have benefits and risks, making it essential to choose based on liquidity needs, investment goals, and risk tolerance.

For more information on REITs, visit the National Association of Real Estate Investment Trusts.