Understanding 1031 Exchanges: A Tax-Deferral Strategy for Real Estate Investors

A 1031 exchange allows real estate investors to defer capital gains taxes when selling an investment property and reinvesting in another. The Internal Revenue Code (IRC) Section 1031 governs this process, helping investors preserve equity and continue building wealth through real estate transactions.

The History of 1031 Exchanges

The concept of a 1031 exchange originated in 1921 when the U.S. Congress introduced it to promote economic growth and investment. Initially, the law permitted like-kind property swaps with minimal restrictions. Over time, amendments refined the process, introducing strict timelines and regulations to ensure compliance. Today, 1031 exchanges remain a crucial tool for investors looking to defer taxes and reinvest in new opportunities.

How a 1031 Exchange Works

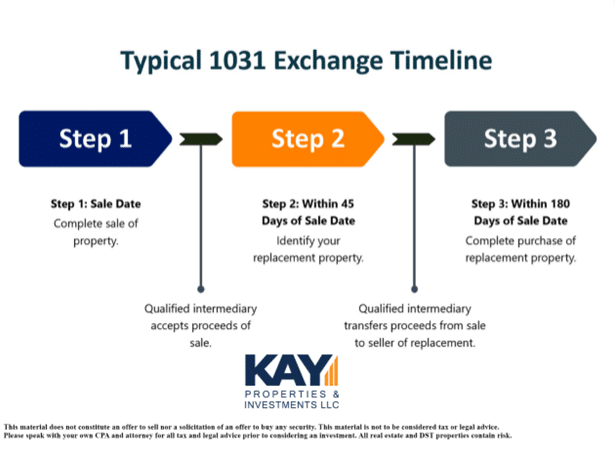

A real estate owner uses a 1031 exchange by selling an investment property and reinvesting the proceeds into a qualifying like-kind property. To qualify, investors must adhere to strict guidelines, including working with a Qualified Intermediary (QI) who holds the sale proceeds until the new property is purchased. The investor must identify potential replacement properties within 45 days and complete the acquisition within 180 days.

Types of Properties Allowed in a 1031 Exchange

To qualify for a 1031 exchange, both the relinquished and replacement properties must be investment or business-use properties. Eligible properties include:

- Apartment buildings

- Office buildings

- Retail centers

- Industrial properties

- Vacant land held for investment

- Rental homes

Primary residences and properties held for resale, such as fix-and-flip projects, do not qualify.

Rules and Timing of a 1031 Exchange

Investors must follow specific rules and timelines to qualify for tax deferral:

- Like-Kind Requirement – The replacement property must be of similar nature, even if different in asset type or location.

- 45-Day Identification Period – Investors must identify up to three potential replacement properties within 45 days of selling the original property.

- 180-Day Closing Period – The purchase of the replacement property must be completed within 180 days from the sale date of the original property.

- Use of a Qualified Intermediary – A QI must facilitate the exchange, ensuring compliance with IRS rules.

- Equal or Greater Value Rule – To fully defer capital gains taxes, the replacement property must be of equal or greater value than the relinquished property.

Advantages of a 1031 Exchange

A 1031 exchange provides significant benefits for real estate investors:

- Tax Deferral – Investors defer capital gains taxes, allowing more capital to be reinvested.

- Portfolio Growth – Investors can upgrade to larger or better-located properties without immediate tax burdens.

- Increased Cash Flow – Exchanging underperforming properties for higher-yield investments improves returns.

- Diversification – Investors can shift assets into different real estate sectors or geographic markets.

- Legacy Planning – Heirs may inherit properties at a stepped-up basis, potentially eliminating deferred taxes.

Conclusion

A 1031 exchange is a powerful strategy for real estate investors looking to defer taxes and maximize investment growth. By following the IRS guidelines, working with a Qualified Intermediary, and understanding timing rules, investors can effectively leverage 1031 exchanges to build long-term wealth.

For more information, visit the IRS 1031 Exchange Guide.